Quality is Integral to Profit

An addendum to "Quality = Profit x Time," providing clarification on the appropriate mathematical formula for Quality.

In Quality = Profit x Time, I define Quality as profit measured over an eternal time horizon and considering all externalities. Another way to think about this concept is the maximization of human prosperity. Does something advance our civilization or degrade it? Given this definition, the formula expressed in the title of the article is misleading. If you haven’t read it yet, I would recommend doing so prior to continuing, as this article is intended as an addendum to clarify the discrepancy between the formula in the title and the philosophical concept explored in the article.

Appropriate Quality Formula

If Quality is equal to profit multiplied by time, as the title of the article leads one to believe, it would mean that as profit increased, Quality would increase. This is generally correct; however, it would also mean that if profit decreased, Quality would decrease. This is not an accurate representation of Quality, defined as “profit measured over an eternal time horizon and considering all externalities” or “maximization of human prosperity.” Given these parameters, negative profit will always decrease Quality, however Quality would continue to increase even if the magnitude of profit decreased, provided it remained positive. Additionally, if the intent is for profit to be measured over an eternal time horizon (i.e., infinity), the original formula would make the magnitude of profit inconsequential, as Quality would only ever be equal to negative infinity, positive infinity, or zero. This is not an exhaustive list of the flaws with the original formula; however, it should be sufficient to prove its inadequacy and to show why a new formula is required. Quality is a complex concept, so a more complex form of mathematics is required to express it. The original formula is algebraic, but the appropriate one shall be expressed with calculus. With all these considerations, the appropriate formula for Quality is the integral of profit, measured from zero to infinity, or:

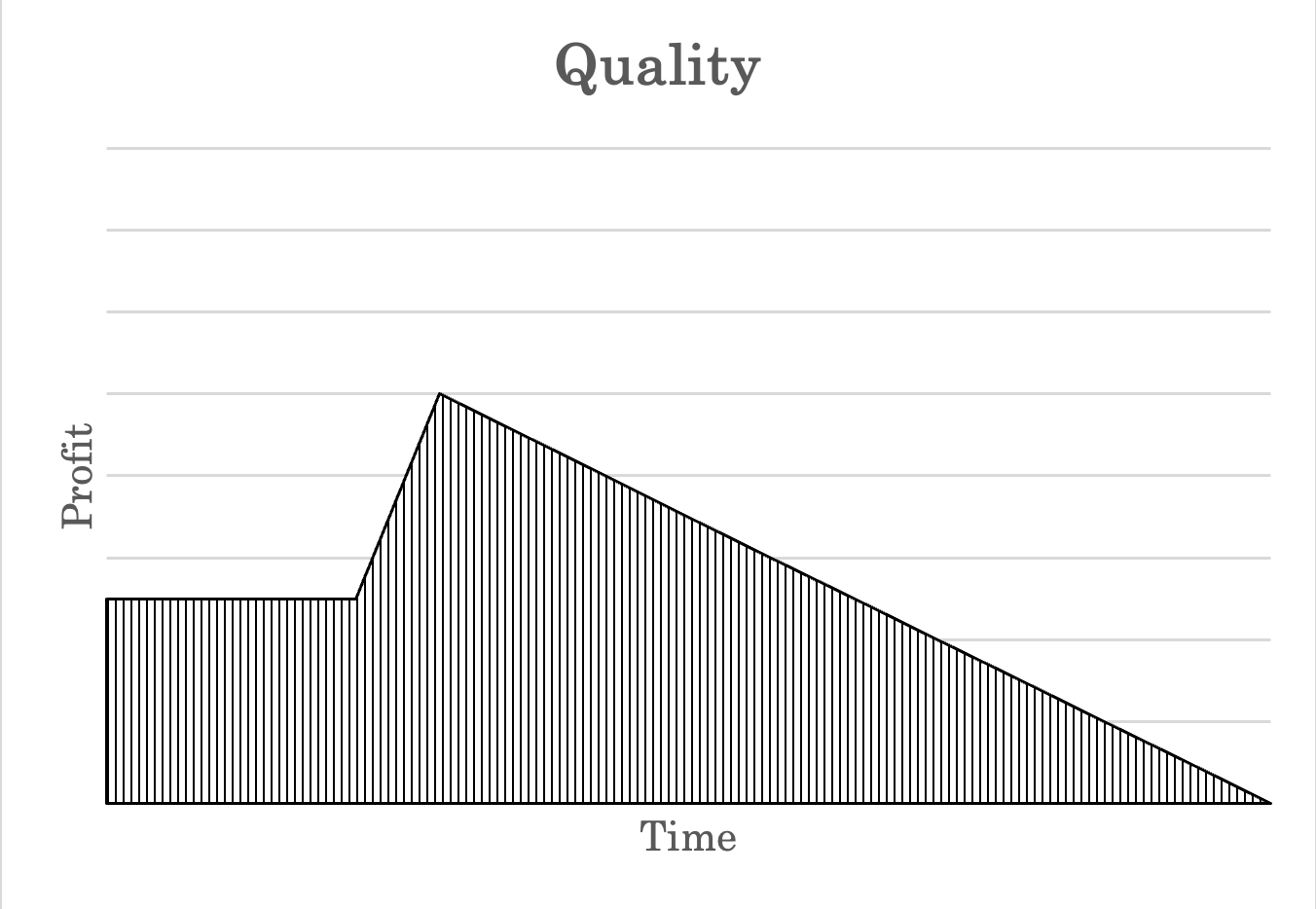

This formula is the most precise definition of the concept; however, knowledge of calculus is not, and should not be, required to understand it. Since the integral of something is equal to the area under the curve, the concept can be visualized using a graphical representation. It cannot technically be shown on a graph from zero to infinity; however, here is a graphical representation of a typical profit curve for an organization with steady yearly growth, over a discrete timeframe:

This graph shows that Quality is cumulative over time. This is due to Quality’s relationship with capital creation. As I explain in Quality in an Abstract Economy, capital is created through Quality actions. Capital is the store of previously generated profit into the future. Capital creation, like Quality, is cumulative. After it is created, capital can only be consumed or destroyed through actions that decrease Quality. As long as profit is positive, Quality will continue to increase. For further illustration, let’s take a look at a few examples of profit curves (over discrete timeframes) that can occur within an organization:

The Result of Quality Actions

This is an example of what a profit curve would look like if decision-makers in an organization took Quality actions, or acted with a low time preference, to address stagnant growth. The decrease in profit seen in the middle could be many different things. For example, it could be an organization that decided to invest in better manufacturing practices to reduce yield loss or it could be that they decided to start spending more on R&D for a few years until they improved their product quality or came up with a new technology. Regardless of the specifics, this is what a typical profit curve would look like if Quality actions are taken:

Although this is a typical representation of how Quality actions manifest in the real world, it isn’t necessary to decrease profit before it starts to increase. It is possible for Quality actions to be taken, or Quality decisions to be made, without any cost.

The Result of Non-Quality Actions

This is an example of what a profit curve would look like if decision-makers in an organization took non-Quality actions, or acted with a high time preference, to address stagnant growth. The sharp increase in profit seen in the middle could be may different things. For example, it could be an organization that decided to cut costs and perform layoffs prior to quarterly earnings reporting. Cost cutting or layoffs are not always non-Quality actions since companies occasionally over hire, but generally speaking, when costs are cut specifically to make profit margins look good in the short-term, it will not improve Quality. Regardless of the specifics, this is what a typical profit curve would look like if non-Quality actions are taken:

Although this is a typical representation of how non-Quality actions manifest in the real world, it isn’t necessary to increase profit before it starts to decrease. It is possible for non-Quality actions to be taken, or non-Quality decisions to be made, without any short-term improvement to profit margins.

Bonus Example – Start-up Company:

In an advanced economy, there are plenty of examples of organizations that operate at a loss and don’t even attempt to generate profit for years. These are generally referred to as “start-up” companies and they are typically bringing a new technology to market or solving a problem that isn’t currently being addressed by the market. Investment in these types of companies requires a low time preference, which is generally associated with Quality, so it is worth taking a brief look at what a typical profit curve would look like for a start-up, provided it is successful:

Since Quality is measured over an eternal time horizon, the initial years of negative profitability become inconsequential over time. When a successful start-up’s profit curve is visualized, it becomes apparent that it is a Quality action. However, if the company closes its doors before breaking even, or is not successful, it is obviously a non-Quality action and will have contributed to the decline of human prosperity. If, however, it stays open for 50 years, even if it generates minimal yearly profit, it is likely to be a Quality action. This example is useful to show how taking the measurement too early, and not over an eternal time horizon, can be deceiving when determining if something is of Quality.

Integrals and Derivatives

A brief etymological note on the calculus terms integral and derivative.

The word integral means essential, vital, or fundamental. This formula implies that Quality is integral to profitability, or to phrase it another way:

Quality is essential to profitability.

Quality is vital to profitability.

Quality is fundamental to profitability.

In calculus, the inverse of an integral is a derivative. The word derivative means the byproduct of, the result of, or derived from. The formula implies that profit is a derivative of Quality, or to phrase it another way:

Profit is a byproduct of Quality.

Profit is the result of Quality.

Profit is derived from Quality.

Opportunity Cost and Externalities

All of the examples previously discussed have been regarding an organization’s internal profit. Although the measurement of Quality is not limited to organizations, the internal profit can best be understood as the profit on a company’s balance sheet. Generally, if an organization is generating internal profit, it is a good sign that Quality actions are being taken and Quality decisions are being made; however, the final determination cannot be made without considering opportunity costs and externalities.

Opportunity cost is the abstract cost born from making one decision over another. For example, a company might decide to select one material over another for a critical component or they might decide to hire for one position and not another. When these decisions differ from the ideal Quality decision, there is an opportunity cost that can be thought of as a cost of non-Quality (CONQ). This cost is never included in a company’s balance sheet, and it is most commonly dismissed by decision-makers, however it can have a significant impact on the Quality of an organization. Given its potential significance, it is important to represent it in the Quality formula. The opportunity cost, or CONQ, can be thought of as the actual profit generated minus the maximum amount of profit possible, or:

NOTE: CONQ is often used as a measurement of the cost of things like nonconformances, reworks, yield loss or scrap rates. If a company is being really thoughtful, they might include cost of complaints and returns, and they may even consider brand impact (not likely). These are very straightforward ways to think of CONQ, but they are simply costs that get rolled into an organizations internal profit at the end of the day. The CONQ used in this formula is intended to represent a cost that is invisible to an organization using standard profit measurements.

Additionally, externalities need to be considered in order to fully understand the impact on human prosperity. Typically, when externalities are discussed, they are referring to negative externalities associated with the environment. For example, the decrease in quality of life or lifespan associated with air or water pollution. There are many other examples, but these are the most common. If Quality is measured using only an organization’s internal profit, the cost associated with negative externalities gets ignored.

Positive externalities, such as the increase in quality of life or the productivity improvements associated with the invention of a new technology, are much less commonly discussed. If Quality is measured using only an organization’s internal profit, the additional profit associated with positive externalities gets ignored. For example, when the first car was invented, Ford didn’t consider the individual productivity gains of its customers in its profit margins, however since they add to the sum total of human prosperity, they should be considered when measuring Quality.

If every action taken and decision made is ideal, the maximum CONQ can be is zero. In the real world, it will always be negative. Since it is negative (or zero), it would have a positive relationship with internal profit. Also, since negative externalities would reduce Quality and positive externalities would increase Quality, this would also have a positive relationship with internal profit. Therefore, the appropriate formula for Quality in the real world, or actual Quality, is the integral of internal profit plus profit from externalities plus the cost of non-Quality, measured from zero to infinity:

Although it is possible to use the formula to measure discrete timeframes, conclusions should not be drawn regarding the Quality of an action or decision based on a timeframe less than eternity. For decision-makers, this may seem as though it lacks utility; however, this formula is intended to aid in the philosophical conceptualization of Quality. Philosophy, at its core, is intended to teach you how to think, not what to think. Taking the time to understand these concepts will help decision-makers learn how to think about Quality in a way that will improve the profitability of their organizations.